AT&T Southeast Bargaining Report #56

CWA is on strike in District 3 because of the company's unfair labor practices. We're protesting against the Company's bad faith bargaining, part of which involves issues around healthcare bargaining. CWA leaders discussed healthcare bargaining with labor relations representatives of the Company, and in those discussions the company's representatives agreed to a framework for healthcare bargaining in District 3. The Company agreed that healthcare bargaining would proceed based on regional costs for healthcare here in the southeast instead of national costs. Shortly after those discussions, however, the Company reneged on the agreement, informing CWA that they had changed their mind. We want members to understand how the Company's backing out of its agreement has impacted bargaining, and why it is important that CWA shine a light on the Company's bad faith tactics.

Healthcare is currently a major issue in negotiations. Our membership has told us that the continuing rise in healthcare costs needs to change. The following information is intended to help explain the Company’s position on how we bargain healthcare and the position we are currently taking.

AT&T calculates the national average cost per wireline represented employee. The Company calculates this by adding the gross covered claims and the administrative expense they incur divided by the number of participating employees. When we are bargaining for a new contract, the Company uses this average cost per employee for the most recent year with full year data available and then projects the cost will increase 5% each year. We then negotiate the monthly contributions and employee out of pocket payments that would generate a target cost share. This cost share is the percentage of the cost per employee our members pay. Our current benefits were negotiated in 2019 at a 29% cost share for employees hired prior to that agreement and a 32% cost share for employees hired during the agreement.

Each bargaining cycle, CWA requests an extensive amount of data related to medical costs over the last contract period. In reviewing the data for the Southeast, the team was able to compare that data to the data we received in the last two rounds of bargaining and found the actual cost trends were much lower than the Company’s projected 5% increase each year. We were already aware that historically the Southeast costs have been lower than the national average.

In discussion with CWA leadership, the decision was made that we would take the position that going forward we would not agree to bargain our medical costs in the Southeast off a national average but off the Southeast costs; in other words, only considering the costs for employees represented under this agreement.

The Company continues to insist that we bargain off the national average costs and continues to present proposals based on that model, with the same 5% annual trend. This has created a big issue in our negotiations. We know this model causes our members to pay more than the 29% target cost share for their actual costs.

Additionally, the Company continues to push a new healthcare option. The Company argues the new option is designed to lower the overall costs and would lower the amount our members pay. The biggest issue with this new option is related to prescription drug costs. Our current Option 1 plan has fixed copays with no deductible for prescription drug coverage. The new option integrates the prescription drug costs with the medical deductibles. That means employees in either medical plan would have to meet their medical deductible before moving to a coinsurance for prescriptions. This adds more out of pocket costs to members than they currently have.

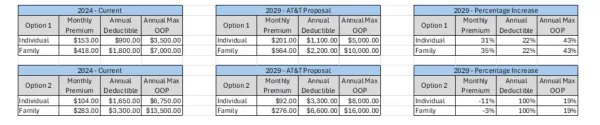

The charts below compare the current Option 1 and Option 2 medical costs with the Company’s most recent proposal on benefits.

Hopefully, this helps explain why we continue to push back on the Company’s proposed medical plan and “Fight For More in ’24.”